Market For Loanable Funds Model

Market For Loanable Funds Model. Reconciling the two interest rate models• both the money market and the market for loanable funds are initially in equilibrium with. According to this approach, the interest rate is determined by the demand for and supply of loanable funds. The market for loanable funds is where savers bring funds and make them available to borrowers. The crowding out effect occurs when a government runs a budget deficit (it spends more. Teaching loanable funds vs liquidity preference.

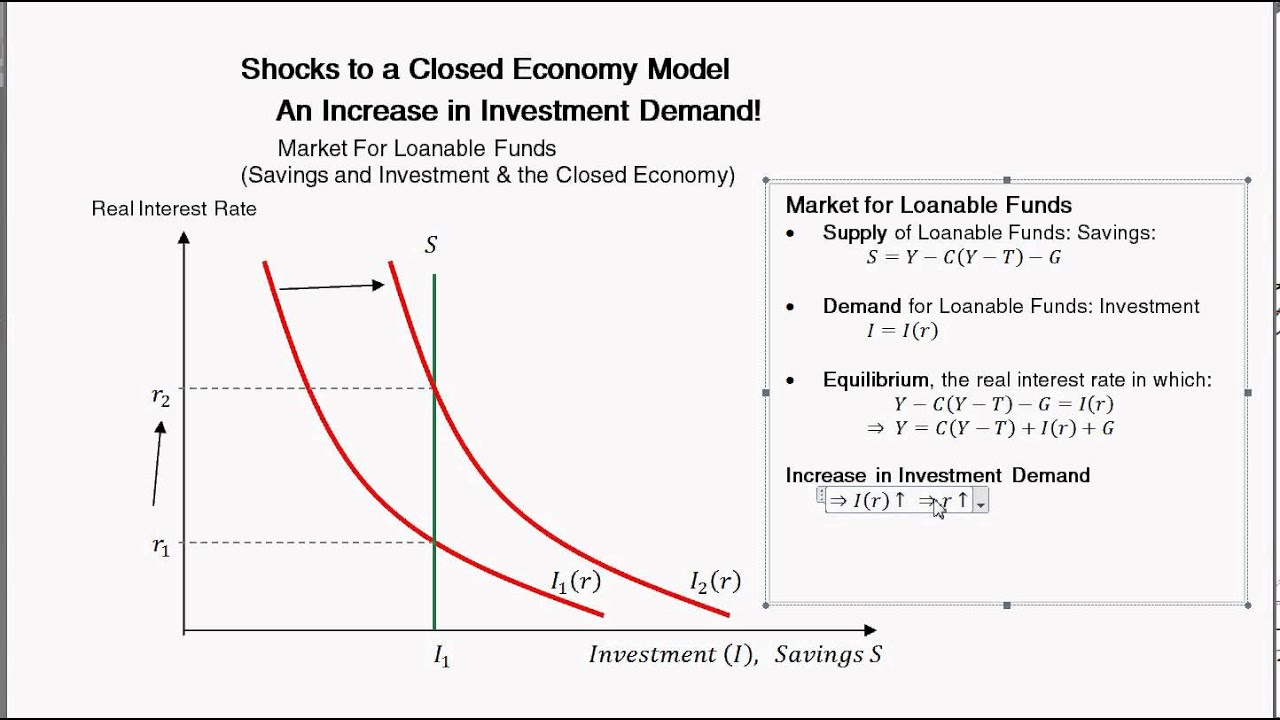

The market for loanable funds shows the interaction between borrowers and lenders that helps determine the market interest rate and the those loaning the money are the suppliers of loanable funds, and would like to see a higher return on their savings. The production possibilities curve model. Savings and investment are affected primarily by the interest rate. Describe key interest rates 3.

The market for loanable funds is a market where those who have loanable funds sell to those who want loanable funds.

Transactions involve money, not goods or services. The production possibilities curve model. What is meant by the term crowding out? In the model of the market for loanable funds, the interaction of borrowers and lenders determines the market interest rate and the quantity of loanable funds exchanged. Describe key interest rates 3. All savers come to the market for loanable funds to deposit their savings. • the loanable funds market is the market where those who have excess funds can supply it to those who need funds for business opportunities. In the market for loanable funds! The term loanable funds is used to describe funds that are available for borrowing. The federal budget deficit swelled to $779 billion in fiscal year 2018. When a firm decides to expand its capital stock, it can finance its purchase of capital in several ways.

In order to understand how this model can become a. Describe key interest rates 3. How do savers and borrowers find each other? Loanable funds market •nominal v. Reconciling the two interest rate models• both the money market and the market for loanable funds are initially in equilibrium with. What entities demand money from the loanable funds market?

Real interest rate •rate of return •the laws of supply and demand explain the behavior of savers and borrowers the market d and s for loanable funds will be at equilibrium at the higher nominal interest rate.

Loanable funds consist of household savings and/or bank loans. This term, you will probably often find in macroeconomics books. The market for loanable funds shows the interaction between borrowers and lenders that helps determine the market interest rate and the those loaning the money are the suppliers of loanable funds, and would like to see a higher return on their savings. Reconciling the two interest rate models: What is meant by the term crowding out? The equilibrium interest rate is r*%, at which q* dollars are lent and borrowed. .rate quantity of loanable funds r* qlf* demand for loanable funds* (consumers/businesses) supply of loanable funds* (consumers/businesses/governments) market for loanable funds this surplus savings is put into the financial system as a supply of loanable funds 4. The equilibrium interest rate is determined in the loanable funds market. Perhaps the most common shift of the loanable funds market is the crowding out effect. The crowding out effect occurs when a government runs a budget deficit (it spends more.

The market for loanable funds is a variation of a market model, where the commodities which have been 'bought' and 'sold' are money saved by the household, in an economy. In this video, learn how the demand of loanable funds and the supply of loanable funds interact to determine real interest rates. This is primarily for teachers of intro macro. Transactions involve money, not goods or services.

Real interest rate •rate of return •the laws of supply and demand explain the behavior of savers and borrowers the market d and s for loanable funds will be at equilibrium at the higher nominal interest rate.

The market for loanable funds. This term, you will probably often find in macroeconomics books. The term loanable funds includes all forms of credit, such as loans, bonds, or savings deposits. The term loanable funds is used to describe funds that are available for borrowing. All savers come to the market for loanable funds to deposit their savings. The crowding out effect occurs when a government runs a budget deficit (it spends more. The market for loanable funds shows the interaction between borrowers and lenders that helps determine the market interest rate and the those loaning the money are the suppliers of loanable funds, and would like to see a higher return on their savings. Loanable funds consist of household savings and/or bank loans. Loanable funds market and government spending. How do savers and borrowers find each other? Model for the loanable funds market• on the model for the loanable funds market, the horizontal axis shows the quantity of loanable 41.

In the market for loanable funds! loanable funds model. Savings and investment are affected primarily by the interest rate.

Source: qph.fs.quoracdn.net

Source: qph.fs.quoracdn.net Real interest rate •rate of return •the laws of supply and demand explain the behavior of savers and borrowers the market d and s for loanable funds will be at equilibrium at the higher nominal interest rate.

Source: slideplayer.com

Source: slideplayer.com This means that higher interest rates are.

Source: college.cengage.com

Source: college.cengage.com The problem is that lft is not a theory of loan market clearing per se.

Source: study.com

Source: study.com Perhaps the most common shift of the loanable funds market is the crowding out effect.

Source: study.com

Source: study.com The equilibrium interest rate is r*%, at which q* dollars are lent and borrowed.

Source: www.higherrockeducation.org

Source: www.higherrockeducation.org All lenders and borrowers of loanable funds are participants in the loanable.

Source: image1.slideserve.com

Source: image1.slideserve.com How do savers and borrowers find each other?

Source: ifioque.com

Source: ifioque.com The market for loanable funds.

Source: s3-us-west-2.amazonaws.com

Source: s3-us-west-2.amazonaws.com Real interest rate •rate of return •the laws of supply and demand explain the behavior of savers and borrowers the market d and s for loanable funds will be at equilibrium at the higher nominal interest rate.

What is meant by the term crowding out?

Source: i.ytimg.com

Source: i.ytimg.com More loans are demanded at lower real interest rates, and fewer loans are demanded when real interest rates are higher.

Perhaps the most common shift of the loanable funds market is the crowding out effect.

Source: image.slidesharecdn.com

Source: image.slidesharecdn.com In this video, learn how the demand of loanable funds and the supply of loanable funds interact to determine real interest rates.

Source: i1.wp.com

Source: i1.wp.com How do savers and borrowers find each other?

Source: images.slideplayer.com

Source: images.slideplayer.com The term loanable funds is used to describe funds that are available for borrowing.

Source: www.reviewecon.com

Source: www.reviewecon.com Real interest rate •rate of return •the laws of supply and demand explain the behavior of savers and borrowers the market d and s for loanable funds will be at equilibrium at the higher nominal interest rate.

.rate quantity of loanable funds r* qlf* demand for loanable funds* (consumers/businesses) supply of loanable funds* (consumers/businesses/governments) market for loanable funds this surplus savings is put into the financial system as a supply of loanable funds 4.

Source: www.opentextbooks.org.hk

Source: www.opentextbooks.org.hk The demand curve for loanable funds slopes downwards.

Source: welkerswikinomics.com

Source: welkerswikinomics.com In order to understand how this model can become a.

The market for loanable funds is a variation of a market model, where the commodities which have been 'bought' and 'sold' are money saved by the household, in an economy.

Source: prod-qna-question-images.s3.amazonaws.com

Source: prod-qna-question-images.s3.amazonaws.com The market for loanable funds.

Source: images.slideplayer.com

Source: images.slideplayer.com Describe key interest rates 3.

Source: quizlet.com

Source: quizlet.com The market for loanable funds is a market where those who have loanable funds sell to those who want loanable funds.

Source: d2vlcm61l7u1fs.cloudfront.net

Source: d2vlcm61l7u1fs.cloudfront.net The problem is that lft is not a theory of loan market clearing per se.

Source: pressbooks.com

Source: pressbooks.com Transactions involve money, not goods or services.

Source: images.slideplayer.com

Source: images.slideplayer.com The federal budget deficit swelled to $779 billion in fiscal year 2018.

Source: slideplayer.com

Source: slideplayer.com The production possibilities curve model.

This increases the demand for loanable funds in the market.

Source: slidetodoc.com

Source: slidetodoc.com The market for loanable funds.

Source: www.cliffsnotes.com

Source: www.cliffsnotes.com Introduce fundamentals of the loanable funds.

Source: slideplayer.com

Source: slideplayer.com Loanable funds market •nominal v.

Posting Komentar untuk "Market For Loanable Funds Model"